Table of Contents

Introduction

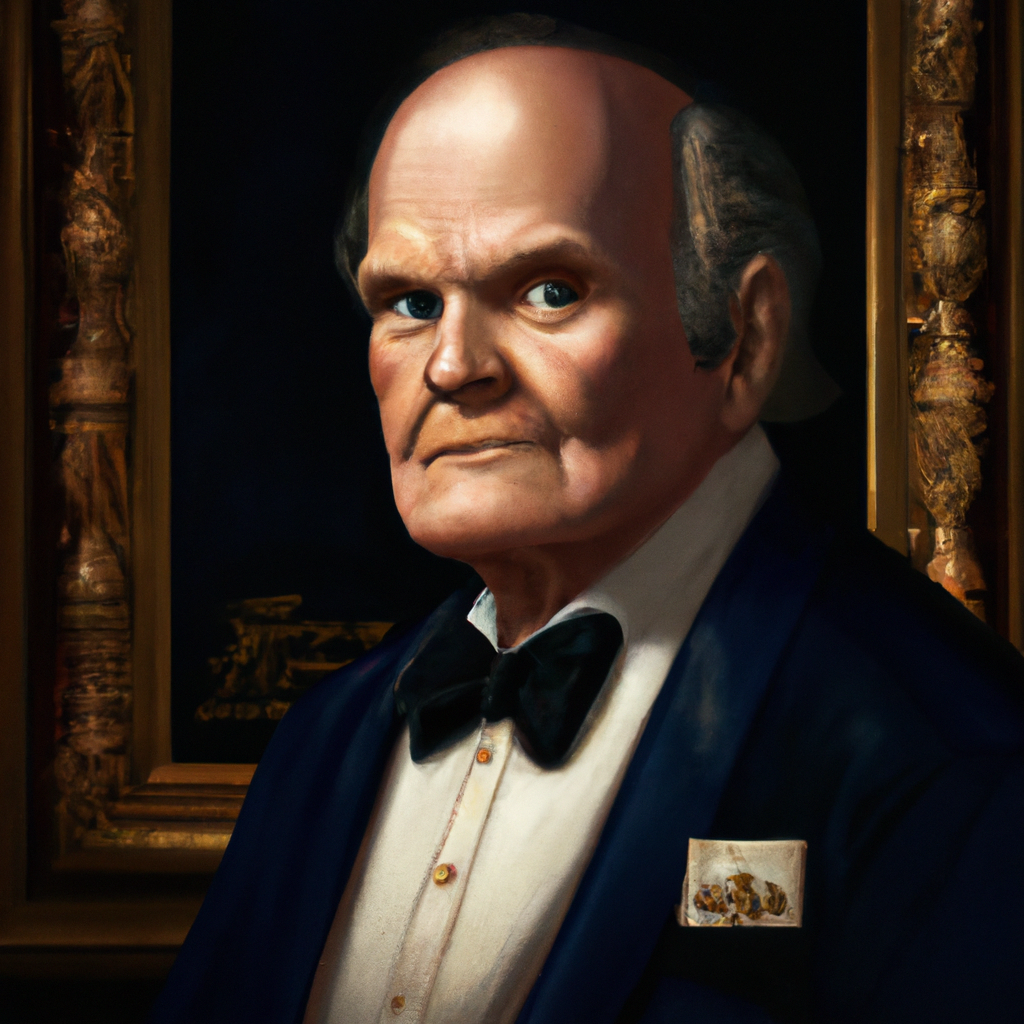

Henry Kravis is one of the most influential and successful investors of the modern era. A co-founder of the renowned private equity firm Kohlberg Kravis Roberts & Co. (KKR), Kravis has made a lasting impact on the business world through his leadership and financial acumen. His career has spanned over four decades, during which he has earned a reputation as a shrewd investor and a master of corporate restructuring. This article takes a look at the life and accomplishments of Henry Kravis, from his early career to his current success. It examines his strategies for success, his philanthropic endeavors, and his legacy as a leader in the business world.

Henry Kravis: A Biography of a Business Icon

Henry Kravis is one of the most iconic figures in the world of business. He is the co-founder of the private equity firm Kohlberg Kravis Roberts & Co. (KKR), and has been instrumental in transforming the private equity industry.

Kravis was born in Tulsa, Oklahoma in 1944. He attended Claremont McKenna College and then went on to receive his MBA from Columbia Business School. After graduating, he worked for the investment banking firm Bear Stearns before joining the private equity firm KKR in 1976.

Kravis is credited with pioneering the leveraged buyout, which is a form of corporate restructuring in which a company is taken private by a group of investors. KKR’s first leveraged buyout was the acquisition of the consumer goods company Beatrice Foods in 1985. Kravis and KKR went on to complete some of the largest leveraged buyouts in history, including the $25 billion buyout of RJR Nabisco in 1988.

Kravis has also been involved in numerous philanthropic activities. He and his wife, Marie-Josée Kravis, are major donors to the Metropolitan Museum of Art in New York City. They have also made large donations to the Mount Sinai Medical Center, the Rockefeller University, and the New York City Ballet.

Kravis is widely respected in the business world and has been honored with numerous awards, including the Lifetime Achievement Award from the Association for Corporate Growth and the Entrepreneur of the Year Award from Ernst & Young. He has also been inducted into the Business Hall of Fame.

Kravis is an example of what can be achieved through hard work and dedication. He has revolutionized the private equity industry and has been a leader in philanthropy. He is a true business icon.

The Business Strategies of Henry Kravis

Henry Kravis is a renowned American businessman and investor who has been instrumental in the success of many businesses. He is the co-founder of the private equity firm, Kohlberg Kravis Roberts & Co. (KKR). Kravis is known for his innovative business strategies and his ability to identify and capitalize on opportunities in the market.

Kravis’s business strategies have been built on a foundation of sound financial principles. He is a proponent of value investing, which involves investing in companies that are undervalued and have the potential to generate significant returns. Kravis is also an advocate of leveraging debt to finance investments, which allows investors to acquire more assets than they could otherwise afford.

Kravis is also a believer in diversification. He believes that investors should spread their investments across a variety of asset classes, industries, and geographic regions in order to reduce risk and maximize returns. He also believes in taking a long-term view of investments, rather than trying to time the market.

Kravis is also a proponent of strategic partnerships. He believes that by forming strategic alliances with other companies, investors can access new markets, resources, and opportunities. Kravis has also been an advocate of mergers and acquisitions, which can help companies to expand their market share and increase their profitability.

Kravis is also a believer in corporate governance. He believes that companies should be managed in a way that is transparent and accountable to shareholders. He has been an advocate of corporate social responsibility, which involves companies taking into account the interests of all stakeholders, including employees, customers, and the environment.

Kravis’s business strategies have been highly successful. He has helped to create some of the most successful companies in the world, such as RJR Nabisco, The Home Depot, and Toys “R” Us. His strategies have also been adopted by many other successful investors and entrepreneurs.

Henry Kravis’ Impact on the Private Equity Industry

Henry Kravis is widely regarded as one of the most influential figures in the private equity industry. He is the co-founder of Kohlberg Kravis Roberts & Co. (KKR), one of the largest and most successful private equity firms in the world.

Kravis has had a tremendous impact on the private equity industry since he founded KKR in 1976. He has been a pioneer in the field, developing innovative strategies and approaches to investing that have become the industry standard. He is credited with creating the leveraged buyout (LBO) model, which involves using borrowed money to purchase a company and then restructuring it to make it more profitable. This model has been used by many private equity firms since then, and has become one of the most successful ways to invest in companies.

Kravis has also been a major advocate for corporate governance reform. He has been vocal in his support for increased transparency and accountability in the private equity industry, and has pushed for stricter regulations and oversight. He has also been a leader in the development of the corporate governance code of conduct, which sets standards for private equity firms and their investments.

Kravis has also been a major force in the philanthropic world. He has donated millions of dollars to charitable causes, and has been a major supporter of education, healthcare, and the arts. He has also been a major advocate for social and economic justice, and has used his influence to support causes such as climate change and poverty alleviation.

Henry Kravis has had a profound impact on the private equity industry, and his influence is still felt today. He has been a leader in the development of innovative strategies and approaches to investing, and has been a major advocate for corporate governance reform and philanthropy. His legacy will continue to shape the industry for years to come.

The Philanthropic Legacy of Henry Kravis

Henry Kravis is a renowned American businessman and philanthropist who has had a lasting impact on the world of philanthropy. Kravis, who is the co-founder of the private equity firm Kohlberg Kravis Roberts & Co. (KKR), has dedicated much of his life to giving back to society.

Kravis has been a major contributor to numerous charitable organizations, including the Robin Hood Foundation, which he co-founded in 1988. The foundation has raised over $2 billion to combat poverty in New York City, and Kravis has personally donated more than $200 million to the cause. Kravis has also been a major supporter of the American Museum of Natural History, donating over $100 million to the institution over the years.

Kravis has also been a major supporter of education. He has made significant donations to a number of universities, including Columbia University, Harvard University, and the University of Southern California. He has also established the Henry R. Kravis Prize in Leadership, which is awarded annually to individuals who have made outstanding contributions to the field of leadership.

Kravis has also been a major supporter of the arts. He has donated millions of dollars to the Metropolitan Museum of Art, the New York Philharmonic, and the Lincoln Center for the Performing Arts. He has also been a major supporter of the film industry, donating millions of dollars to the Tribeca Film Institute and the Sundance Institute.

Kravis’s philanthropic legacy is a testament to his commitment to giving back to society. His generous donations have had a lasting impact on the world of philanthropy, and his legacy will continue to inspire future generations of philanthropists.

Henry Kravis’ Role in the Development of the Modern Financial System

Henry Kravis is widely recognized as one of the most influential figures in the development of the modern financial system. He is best known for his pioneering work in leveraged buyouts, a form of corporate restructuring that has become a cornerstone of modern finance.

Kravis began his career in finance in the 1970s, working as an analyst for the investment bank Bear Stearns. He quickly rose through the ranks, eventually becoming a partner in the firm. In 1976, he and two of his colleagues, George Roberts and Jerome Kohlberg, left Bear Stearns to form their own firm, Kohlberg Kravis Roberts & Co. (KKR).

At KKR, Kravis and his partners pioneered the use of leveraged buyouts to acquire companies. Leveraged buyouts involve the use of borrowed money to purchase a company, allowing the acquirer to take control of the company without having to put up a large amount of their own capital. This approach allowed KKR to acquire large companies with relatively small amounts of capital.

Kravis and KKR were at the forefront of the leveraged buyout boom of the 1980s, acquiring a number of large companies such as RJR Nabisco and Safeway. Kravis and KKR’s success in leveraged buyouts led to the widespread adoption of the technique by other firms, and it has since become a cornerstone of modern finance.

Kravis has also been an active philanthropist, donating large sums of money to a variety of causes. He is a major supporter of the Robin Hood Foundation, a charity that works to combat poverty in New York City. He has also donated to a number of educational institutions, including his alma mater, Claremont McKenna College.

Henry Kravis has had a profound impact on the modern financial system. His pioneering work in leveraged buyouts has revolutionized the way companies are acquired and restructured, and his philanthropic efforts have made a positive difference in the lives of many. He is truly one of the most influential figures in the history of finance.

Excerpt

Henry Kravis is a renowned businessman and philanthropist. He is known for his pioneering work in private equity and venture capital, and his leadership of the firm KKR. He has been instrumental in numerous large-scale investments and mergers, and is a major donor to charitable causes.